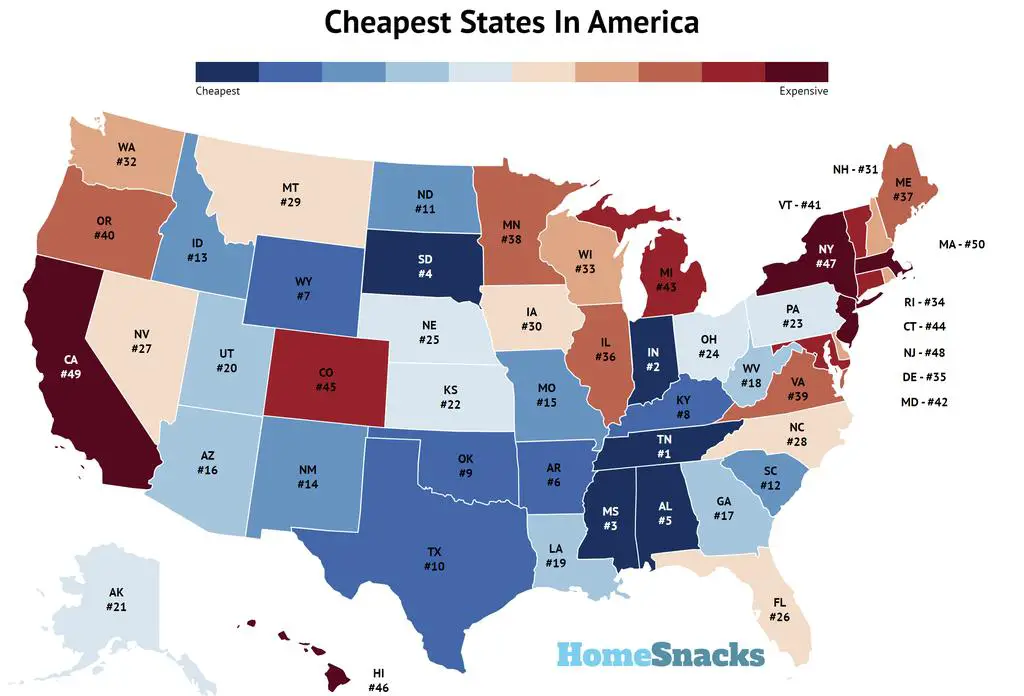

Today, we’re going to talk about the cheapest – or most affordable – states you can live in America. These states are going to be cheap for a reason. A family of 2 adults and 1 child requires $83,897 to reach a living wage in Tennessee. That’s almost 30% cheaper than Massachusetts where it takes $131,461 to reach a living wage.

If you’re struggling to make ends meet or broke as a joke, that’s probably because you either spend too much money or it’s really expensive where you live. There are some places in the country where you can earn a lot of money and still feel poor. We’re talking San Francisco or New York City — where a 2 bedroom apartment costs over $4,000 a month on average.

Well, thank god we don’t have to live there. Instead, we can choose to live in some of the cheapest places in the country. Where a dollar of income goes way further than the big cities mentioned earlier. Take Tennessee, the cheapest state in the country this year according to MIT’s Living Wage data. These states let you live your life without worrying about your bank account.

In particular, we analyzed MIT’s living wage requirement by state for a family of three and ranked the states from lowest amount required to highest.

The 10 Cheapest States In The United States For 2023

1. Tennessee

Welcome to the wonderfully cheap (except Nashville) state of Tennessee. We’re back to some Southern living. Taxes? Really low. Food costs? Really low. Housing costs are slightly higher than most of the other places on this list at about $810 a month, but that’s still really low for most people watching this video, wishing their mortgage payment was 810 dollars.

However, it must be mentioned that Tennessee, overall, perhaps surprisingly, is one of the most dangerous states in the nation. Especially Memphis, which is one of the more dangerous big cities in America. If you move to Tennessee to start a better life and downsize, make sure you know where you’re moving or we might not ever hear from you again.

Rank Last Year: 1 (No Change)

Living Wage: $83,897

Housing: $11,743

Child Care: $12,819

More On Tennessee: Photos | Rent

2. Indiana

Here in Indiana, the living wage is about $52,000 a year. That means that if you make this amount of money each year – as a household – you can live comfortable enough. Sure, you’ll have to work until you’re 70 and you probably won’t have a big ole boat, but at least you won’t be on welfare. And, the housing costs in Indiana are about $9,600 a year. That means your mortgage or rent payments will be about 800 bucks a month. Not too shabby if you ask me.

In comparison, in our most expensive state to live, California, you need to make about $68k a year to live a decent life. And believe you me, that’s nowhere near enough. Try living in San Francisco on $68k a year and you’ll be renting a bedroom in the tenderloin district with a window that looks out on a sidewalk with poop on it. The living wage for the city of San Francisco is $89,000. That’s just to get by without struggling. That’s the most expensive place you can live in the US.

Rank Last Year: 4 (Up 2)

Living Wage: $87,486

Housing: $11,099

Child Care: $12,628

More On Indiana: Photos | Rent

3. Mississippi

Our third cheapest state in America is… Mississippi. Like the other cheap states, food and personal necessities are very cheap here — actually the cheapest you’ll find in America. The most affordable place in the cheapest state would be Aberdeen.

Here in the Magnolia State, the cost to rent? or buy is about $795 a month. That’s REALLY low. It also costs far cheaper here for food, child care, health care, and every other care you can name. And, of note, Mississippi has by far the cheapest child care costs of any other state – even $150 a month less than Arkansas! You can be daddy warbucks around here if you bring in anything over 50k.

Now, some people might say – it’s Mississippi. Why would I want to live there? There’s a reason it’s so cheap.

Rank Last Year: 2 (Down 1)

Living Wage: $87,723

Housing: $10,218

Child Care: $10,960

More On Mississippi: Photos | Rent

4. South Dakota

We’re gonna ride the rails all the way up to our next cheapest state, South Dakota. In South Dakota, a family can get by pretty comfortably on about $4,200 a month in income. Housing and food will cost you about $1,300 a month total. Not too bad at all. But the real kicker is there’s no income taxes in South Dakota. This means South Dakota has the lowest taxes in America. Sure beats New York, where people spend about a thousand bucks a month in taxes alone.

Yuck.

Of course, it IS South Dakota. But with all your extra savings here, you can go out and buy up all of the Bierocks and and pheasants and walleye and chislic? You want? What is this stuff? This is what South Dakotans eat?

Rank Last Year: 6 (Up 2)

Living Wage: $88,018

Housing: $10,429

Child Care: $15,181

More On South Dakota: Photos | Rent

5. Alabama

The Alabama tide rolls into the fifth cheapest state spot for 2023. Relatively high taxes and medical care for the South prevented the state from appearing higher on our list. Here in Alabama, the living wage is about $50,000, or about $25 an hour. And if both people work, than you each only really need minimum wage jobs to live a decent life in the Heart of Dixie.

If it wasn’t for the higher than average taxes here, and above average healthcare costs, Alabama would be in the top 5 for sure.

Rank Last Year: 3 (Down 2)

Living Wage: $88,041

Housing: $10,597

Child Care: $12,320

More On Alabama: Photos | Rent

6. Arkansas

It’s time we check out our sixth cheapest state in which to live, Arkansas, giving the South a clean one-two sweep of the cheapest states to live.

Don’t everyone jump up at once.

Okay, so it’s Arkansas, but what did you expect? You get what you pay for here, which isn’t a lot either way. Like we mentioned with Mississippi, the core necessities in Arkansas are as cheap as you can find in America.. An Arkansawian can make about $48k a year, and spends about only about 708 dollars a month on rent or mortgages. That’s probably half what you spend. And that’s also the lowest housing costs in America.

However, the reason it’s the second cheapest place to live is people earn the second lowest salaries in America, so if you want to move here to movin on up in the world, you’d better make another plan.

Rank Last Year: 5 (Down 1)

Living Wage: $89,708

Housing: $9,778

Child Care: $13,871

More On Arkansas: Photos | Rent

7. Wyoming

Wyoming stands out as one of the 7th cheapest states in the United States for several compelling reasons.

First and foremost, its relatively low population density translates to lower demand for housing and reduced competition for jobs. This contributes to a more affordable cost of living, with housing costs, in particular, being notably reasonable.

A family of four can comfortably manage with an annual budget of $90,032. The state’s wide-open spaces and abundant natural resources, such as oil and coal, also keep energy costs relatively low.

Additionally, Wyoming does not impose a state income tax, which can significantly lighten the financial burden on its residents.

All these factors combined make Wyoming an attractive destination for those seeking an affordable and economically stable environment to call home.

Rank Last Year: 12 (Up 5)

Living Wage: $90,032

Housing: $11,278

Child Care: $16,836

More On Wyoming: Photos | Rent

8. Kentucky

Our next cheapest place to live isn’t too far away, as we take a spin in Kentucky. I have a feeling we’re going to be in the south a lot for this trip.

Here in Kentucky, housing costs are actually the third lowest in the entire nation behind Arkansas and West Virginia. It’s relatively more expensive for food than other states on this list, and for some reason, child care costs in Kentucky are a little more expensive – at about 523 dollars a month.

Life is slow in Kentucky – so if you want cheap and a whole lotta rolling hills, then this is your place. You can probably get a trailer and get a job down at Ramsey’s. Sounds like a great life to me. Of course, the dating scene down in Kentucky is challenging.

Rank Last Year: 8 (No Change)

Living Wage: $91,250

Housing: $10,504

Child Care: $15,812

More On Kentucky: Photos | Rent

9. Oklahoma

The ninth most affordable state for 2023 is Oklahoma based on the most recent set of living wage data. The living wage takes into account the cost of living via childcare, taxes, utilities, and, most importantly, housing costs. In Oklahoma, housing is cheap, hence their ninth place ranking this year. The overall cost of living is 6.1% lower than the US average.

Some of the more more affordable metros include the Tulsa area and Adair County. In fact, Adair County has the cheapest housing in the state per the most recent Census data. Our data shows that Anadarko is the cheapest place to live, some 50 miles outside of Oklahoma City.

Rank Last Year: 9 (No Change)

Living Wage: $91,789

Housing: $10,894

Child Care: $14,600

More On Oklahoma: Photos | Rent

10. Texas

Texas has surged up the affordability scale, landing in the 10th position as one of the most affordable states, climbing a remarkable nine spots from the previous year. The Lone Star State offers a relatively low cost of living, making it an attractive destination for families and individuals alike.

With a Living Wage for a family of four set at $91,949, Texas manages to keep expenses in check compared to many other states. Housing costs, averaging $14,544 annually, are notably affordable, extending to child care at $15,140 annually.

Another factor contributing to Texas’ affordability is its need for state income tax. The absence of state income tax allows residents to keep more of their earnings, making it an attractive destination for individuals and families looking to maximize their disposable income.

Rank Last Year: 19 (Up 9)

Living Wage: $91,949

Housing: $14,544

Child Care: $15,140

More On Texas: Photos | Rent

Methodology: How We Determined The Cheapest States In The United States For 2023

When we at HomeSnacks normally measure how affordable a place to live is we check in on whats called a cost of living index. That analyzes the costs of goods in basket of things like housing, milk, utilities, and gas across in each state across the United States.

But for this analysis we had an even better source — MIT’s Living Wage data.

The team at MIT compiles the best set of geographical data on what a family of various sizes can realistically expect to spend to live a decent life each year. Not super comfy, but not in poverty.

In particular they look at the cost of the following items by state:

- Food

- Child Care

- Medical

- Housing

- Transportation

- Other Personal Necessities

- Taxes

They just updated their state level data for 2023.

We took their average required wage in each state for two adults and one child and ranked them from lowest to highest. The lowest state, Mississippi, was crowned the cheapest state to live in America for 2023. You can download the data here.

Summary: The Cheapest States In America To Live For 2023

Okay, so that’s it. Our cheapest states in America. After all the dust settled and the analysis was over, we crowned Tennessee as the cheapest state to live in the United States for 2023.

While it’s good news for Tennessee that a dollar goes further there any other place in the country, the downside might be the reason behind it. People are willing to pay more to live in nicer places — that whole supply and demand thing. Remember, there’s nothing wrong with living a cheap life, and being content with the way things are. If your car runs, you have heat on, and you can go out every now and then, then you have it better than like 70% of the rest of the world.

So even though it might be cheap to live in Tennessee, Tennessee still might be a better place to call home if you can afford it.

If you’re curious, here are the most expensive states you can live in America. If you live in one of these expensive places, and you’re thinking about moving away and starting over – somewhere cheap, and where your ex wife can’t find you, we gave you a good list to start looking into more. Here’s a quick look at the most expensive states in America:

- Massachusetts

- California

- New Jersey

For more reading, check out:

Cheapest States In The United States For 2023

| Rank | State | Living Wage |

|---|---|---|

| 1 | Tennessee | $83,897 |

| 2 | Indiana | $87,486 |

| 3 | Mississippi | $87,723 |

| 4 | South Dakota | $88,018 |

| 5 | Alabama | $88,041 |

| 6 | Arkansas | $89,708 |

| 7 | Wyoming | $90,032 |

| 8 | Kentucky | $91,250 |

| 9 | Oklahoma | $91,789 |

| 10 | Texas | $91,949 |

| 11 | North Dakota | $92,402 |

| 12 | South Carolina | $92,403 |

| 13 | Idaho | $92,959 |

| 14 | New Mexico | $93,307 |

| 15 | Missouri | $93,313 |

| 16 | Arizona | $93,390 |

| 17 | Georgia | $93,709 |

| 18 | West Virginia | $94,345 |

| 19 | Louisiana | $94,383 |

| 20 | Utah | $95,825 |

| 21 | Alaska | $96,146 |

| 22 | Kansas | $96,685 |

| 23 | Pennsylvania | $96,838 |

| 24 | Ohio | $96,867 |

| 25 | Nebraska | $97,688 |

| 26 | Florida | $98,260 |

| 27 | Nevada | $98,287 |

| 28 | North Carolina | $99,045 |

| 29 | Montana | $99,226 |

| 30 | Iowa | $99,341 |

| 31 | New Hampshire | $100,284 |

| 32 | Washington | $100,755 |

| 33 | Wisconsin | $100,989 |

| 34 | Rhode Island | $102,430 |

| 35 | Delaware | $102,538 |

| 36 | Illinois | $102,602 |

| 37 | Maine | $103,080 |

| 38 | Minnesota | $104,489 |

| 39 | Virginia | $106,289 |

| 40 | Oregon | $106,292 |

| 41 | Vermont | $107,940 |

| 42 | Maryland | $109,820 |

| 43 | Michigan | $109,962 |

| 44 | Connecticut | $109,977 |

| 45 | Colorado | $110,692 |

| 46 | Hawaii | $118,409 |

| 47 | New York | $119,150 |

| 48 | New Jersey | $123,141 |

| 49 | California | $127,052 |

| 50 | Massachusetts | $131,461 |

Cheapest Places By State

Cheapest Places To Live In Alaska

Cheapest Places To Live In Alabama

Cheapest Places To Live In Arkansas

Cheapest Places To Live In Arizona

Cheapest Places To Live In California

Cheapest Places To Live In Colorado

Cheapest Places To Live In Connecticut

Cheapest Places To Live In Delaware

Cheapest Places To Live In Florida

Cheapest Places To Live In Georgia

Cheapest Places To Live In Hawaii

Cheapest Places To Live In Iowa

Cheapest Places To Live In Idaho

Cheapest Places To Live In Illinois

Cheapest Places To Live In Indiana

Cheapest Places To Live In Louisiana

Cheapest Places To Live In Massachusetts

Cheapest Places To Live In Maryland

Cheapest Places To Live In Maine

Cheapest Places To Live In Michigan

Cheapest Places To Live In Minnesota

Cheapest Places To Live In Missouri

Cheapest Places To Live In Mississippi

Cheapest Places To Live In Montana

Cheapest Places To Live In North Carolina

Cheapest Places To Live In North Dakota

Cheapest Places To Live In Nebraska

Cheapest Places To Live In New Hampshire

Cheapest Places To Live In New Jersey

Cheapest Places To Live In New Mexico

Cheapest Places To Live In Ohio

Cheapest Places To Live In Oklahoma

Cheapest Places To Live In Oregon

Cheapest Places To Live In Pennsylvania

Cheapest Places To Live In Rhode Island

Cheapest Places To Live In South Carolina

Cheapest Places To Live In South Dakota

Cheapest Places To Live In Tennessee

Cheapest Places To Live In Texas

Cheapest Places To Live In Utah

Cheapest Places To Live In Virginia

Cheapest Places To Live In Vermont

Cheapest Places To Live In Washington

Cheapest Places To Live In Wisconsin